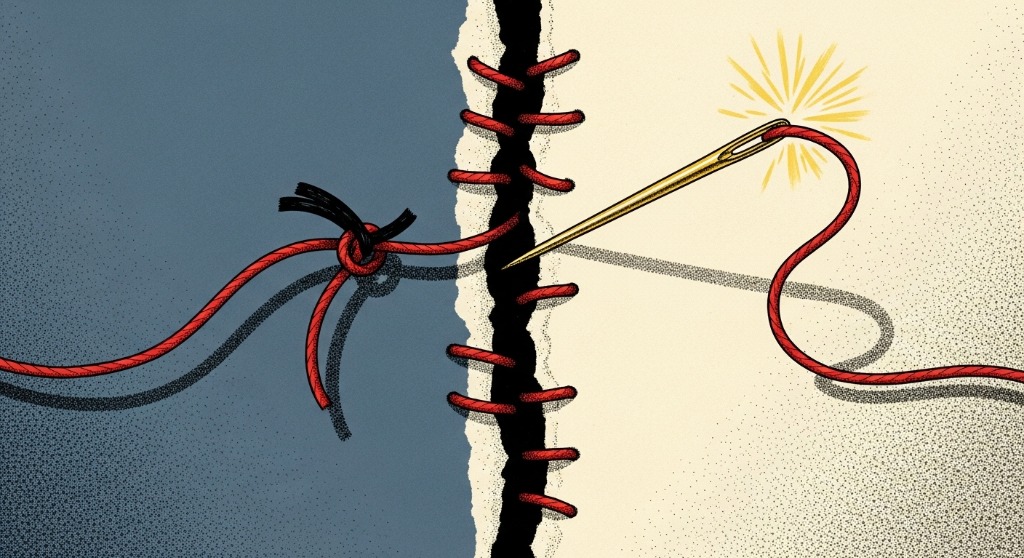

Rebuilding Financial Trust: Bridging the Gap Between Institutions and Individuals

By 2026, the global financial system faces a paradox: institutions possess record capital buffers and digital efficiency, yet individual trust has decoupled from systemic stability. This report argues that trust is no longer a function of brand affinity or "friendly" marketing, but of Recourse—the ability of a customer to rectify errors in an automated system. We identify that "Short-Termism" in fee structures and "Decision Paralysis" in data-rich fraud prevention have created a "Time Tax" on consumers. To rebuild credibility, institutions must shift from optimising for transaction speed to optimising for Fairness and Agency. We present a 10-step roadmap for banks and fintechs to close the Trust Gap by treating Recourse as a core product, not a cost centre.

Core Strategic Insight

Trust in 2026 is mechanical, not emotional; it is built on the visible capacity of an institution to reverse its own automated errors without inflicting a "Time Tax" on the customer.

Diagnostic Analysis: The Anatomy of Distrust

Our analysis suggests that the erosion of trust is not a vague sentimental shift, but a rational response to structural changes in banking operations over the last decade (2016–2026). The "efficiency" gains of the previous cycle have now manifested as "fragility" in customer relationships.

The "Time Tax"

The digitization of banking promised convenience, but for many, it has introduced a "Time Tax." When a bank automates fraud detection, false positives increase. For the bank, this is a risk success. For the customer, it is unpaid labour—verifying identity, navigating chatbots, and waiting in queues. This asymmetry is the primary driver of modern resentment.

Scarcity by Design

Research shows that scarcity reduces "mental bandwidth." When institutions introduce complex, hidden, or "junk" fees (overdrafts, inactivity fees), they force customers into a scarcity mindset. This triggers "tunnelling," where the customer focuses solely on the immediate threat and loses loyalty. Banks have inadvertently designed a customer base that is cognitively overloaded.

The "Human Void"

While 85% of enterprises view AI adoption as essential, consumers increasingly view "Humital" banking (Human + Digital) as premium. Large institutions that replaced frontline staff with AI have created a "Human Void." In moments of crisis—fraud, stress, bereavement—the absence of a human agent signals indifference.

Governance Failure

The pressure for quarterly returns has driven "short-termism," leading to underinvestment in resilient legacy systems. This manifests as "Technical Debt" causing outages and data breaches. Customers interpret these not as glitches, but as evidence that the bank prioritises shareholder dividends over deposit safety.

Strategic Implications

For Margin and Unit Economics

The "Junk Fee" era is ending. Regulatory regimes in the UK (Consumer Duty), US (CFPB actions), and EU are effectively capping revenue models based on consumer error (e.g., late fees). Banks must pivot unit economics from "penalty revenue" to "value-add subscriptions" or transparent advisory fees. This requires a repricing of core services that may initially depress margins but will stabilise long-term customer lifetime value (CLV).

For Risk and Governance

The "AI Security Zugzwang" (Alevizos, 2024) describes the forced move where banks must adopt AI to stay competitive but introduce new vulnerabilities they cannot fully control. Governance must shift from "prevention" to "resilience." It is impossible to prevent all AI-driven fraud; therefore, the competitive advantage lies in the speed and fairness of reimbursement and rectification. Trust is won in the recovery, not the prevention.

For Operating Cadence

Institutions must measure "Resolution Effort" (Customer Effort Score) as a board-level metric. If it takes a customer 4 hours to resolve a bank error, that is a failure of operating cadence. The 2026 standard is "One-Touch Resolution" for 90% of routine disputes.

Exhibits

10-Step Implementation Roadmap

Rationale: Minimizing customer effort is the single highest predictor of loyalty.

Rationale: Scarcity-driven revenue models are regulatory liabilities in 2026.

Rationale: The "Human Void" during stress events destroys trust.

Rationale: Building client capability builds client wealth (and deposit base).

Rationale: Explainability is the prerequisite for AI trust (Sunny, 2025).

Rationale: Physical presence signals commitment to the local economy.

Rationale: Control over data reduces the feeling of vulnerability.

Rationale: The administrative cost of investigation often exceeds the loss.

Rationale: Aligns employee behaviour with the "Recourse" objective.

Rationale: Pre-empts regulatory action on disparate impact.

Regional Lens

- United Kingdom: The FCA's "Consumer Duty" regime is the gold standard here. Banks must evidence "good outcomes." Trust is now a compliance metric, not just a marketing one.

- USA: The war on "Junk Fees" dominates. Regional and Community Banks have a strategic advantage in trust over national giants, as per the BNY 2024 Survey.

- Australia & NZ: Scams are the primary trust erosor. Implementation of the "Confirmation of Payee" and reimbursement models is the critical trust battleground.

- Japan: Trust is high but digital adoption is low. The challenge is "Humital" banking—introducing digital efficiency without breaking the high-touch service culture.

- Africa: Mobile money (M-Pesa, etc.) drives trust through utility and uptime. The challenge is data privacy and protecting users from predatory digital lending apps.

Closing Signal

The era of "lazy trust"—earned simply by being a large, stable building in the town square—is over. In 2026, trust is an active, mechanical exchange. It is earned when a bank proves, through its architecture and its culture, that it is on the customer's side when things go wrong. The institutions that win the next decade will be those that lower the "Time Tax" and close the "Recourse Gap."