Why Refinancing Has Become the Real Business Model

Executive Summary

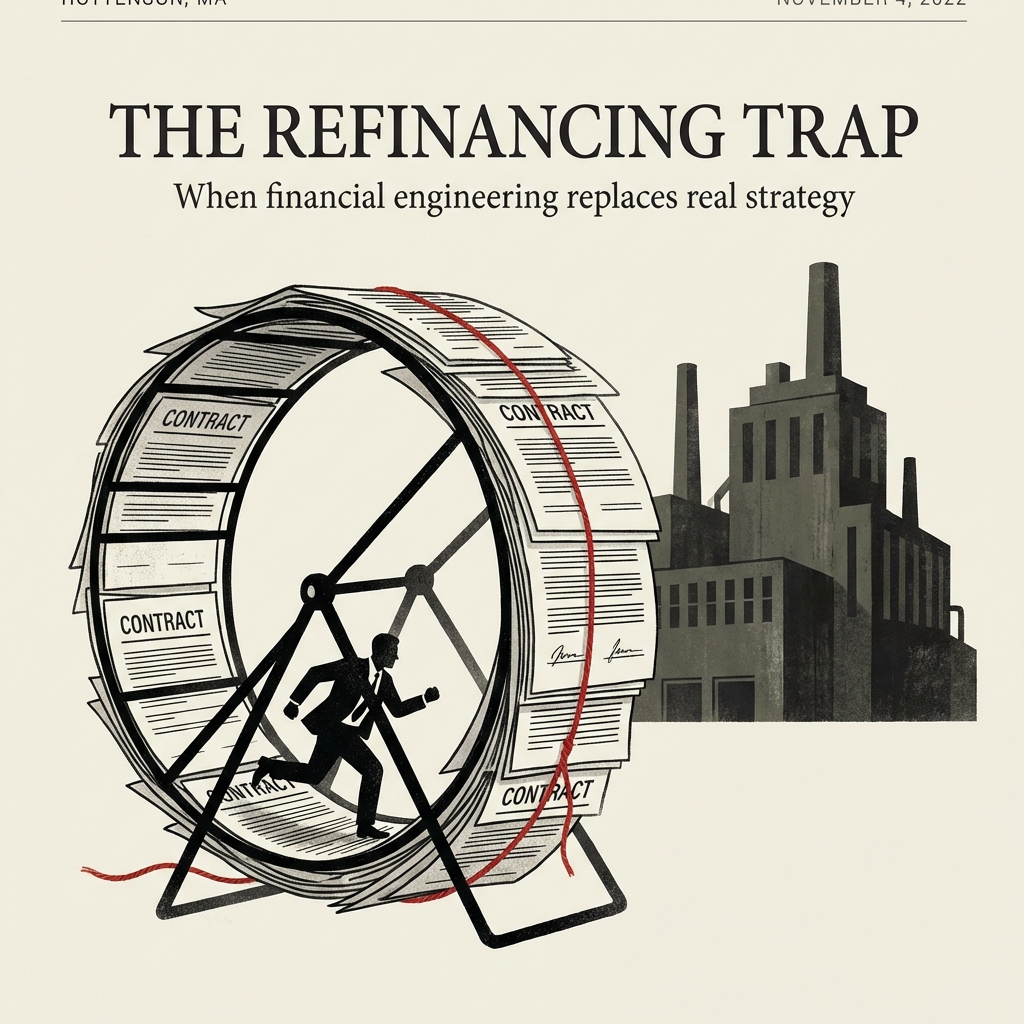

In 2026, a significant cohort of mid-market and PE-backed corporations have structurally shifted from entities designed to repay debt to entities designed solely to service and roll it. With the "Maturity Wall" of the 2020/21 vintage now cresting, and Private Credit firms incentivised to "extend and pretend", operational strategy has become secondary to capital markets engineering. The concept of "Repayment" is obsolete; the goal is now perpetual duration management.

Diagnostic Analysis: The Mechanics of Dependency

The transition from "borrowing to grow" to "borrowing to exist" has been driven by the "Amend and Extend" Trap and Bullet Maturity Addiction. Private Credit funds avoid defaults by pushing maturity out in exchange for higher spreads and fees. The company survives, but the "Fee Layer" grows.

Exhibits

Click quadrants to diagnose status.

Estimate the effective cost of capital when fees are included.

Breaking the Cycle: A 10-Step Roadmap

Regional Lens

- USA: Epicenter of "Amend & Extend". High liquidity but high fees.

- UK: Stricter insolvency rules make "Zombie" strategies riskier.

- Australia/NZ: Banks are quicker to enforce; "extend" flexibility is lower.