Why Financial Discipline Becomes Fashionable in Hard Times

Executive Summary

In the corporate world, financial discipline is frequently misunderstood as a reaction to crisis rather than a prerequisite for resilience. This report analyses the "Boom-Bust" operating model, where companies accumulate structural bloat during economic expansions ("The Magpie Effect") only to engage in damaging, reactive austerity when conditions tighten.

Our analysis indicates that this cyclical approach to discipline is driven by deep-seated behavioural biases—specifically myopic loss aversion and narrative contagion—rather than rational capital allocation. The result is "hysteresis," or permanent economic scarring, where short-term cuts to "muscle" (R&D, brand, talent) during a downturn permanently impair a firm's recovery trajectory. We argue that true efficiency must be decoupled from the economic cycle to avoid the "value trap" of defensive finance.

Diagnostic Analysis: The Anatomy of the Boom-Bust Cycle

Why do intelligent leadership teams repeatedly fall into the trap of bloating in good times and panic-cutting in bad? The answer lies not in incompetence, but in the intersection of behavioural finance and structural incentives. Our diagnostic identifies four mechanisms that drive this "defensive finance" cycle.

Mechanism 1: The "Magpie Effect" and Asymmetric Cost Behaviour

During periods of economic expansion, the cost of capital is typically low, and the pressure to grow top-line revenue is immense. This environment triggers what we term the "Magpie Effect": leaders chase new initiatives, acquisitions, and "shiny" projects without rigorous unit economic validation.

The structural issue here is cost stickiness. Research confirms that Selling, General, and Administrative (SG&A) costs are "sticky"—they rise rapidly when sales increase but fall sluggishly when sales decline (Anderson et al., 2003; Zhong et al., 2020). Managers are psychologically predisposed to view revenue dips as temporary (delaying cuts) but view revenue gains as permanent (accelerating hiring). When the downturn inevitably solidifies, the firm is left with a cost structure built for a "fantasy" revenue level, necessitating deep, traumatic cuts.

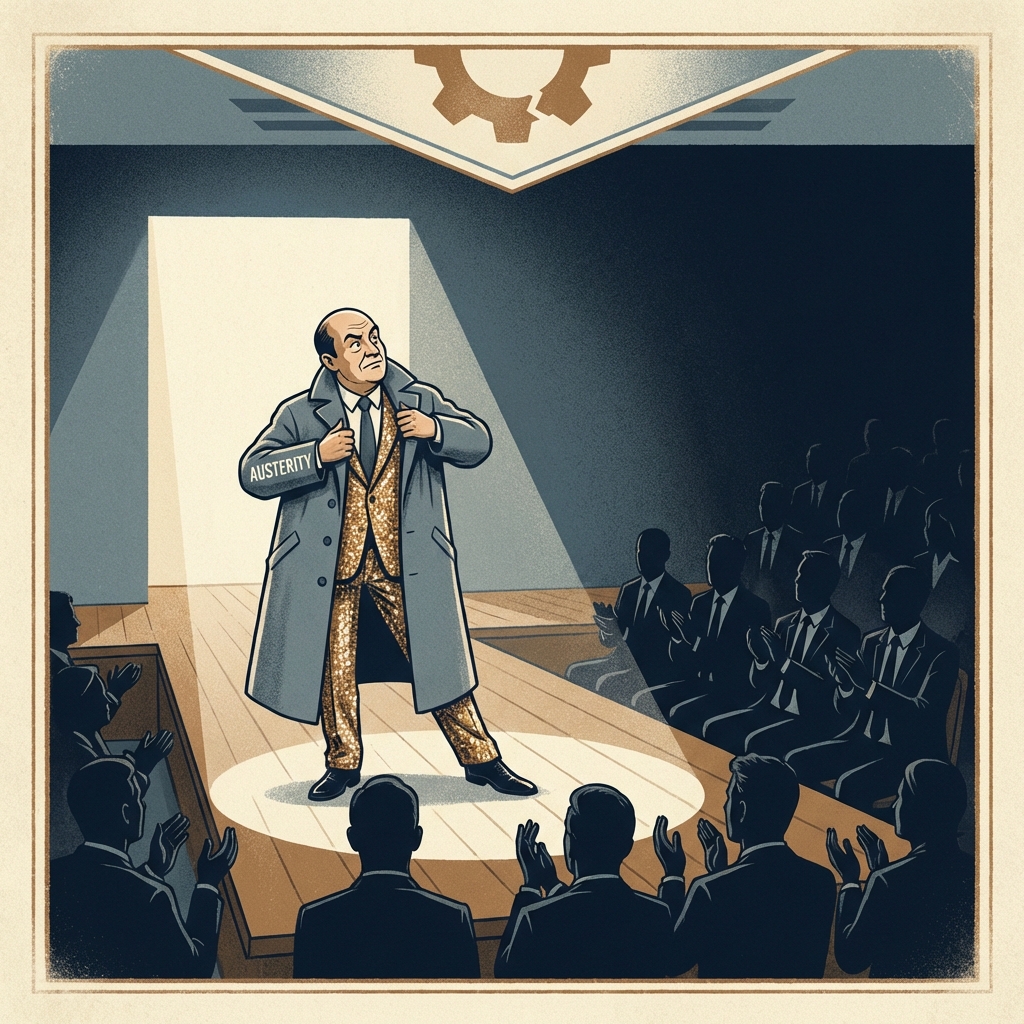

Mechanism 2: Narrative Contagion and the "Year of Efficiency"

Shiller’s Narrative Economics (2017) posits that economic behaviours are viral. In 2025-2026, we observe a "contagion of discipline." When a bellwether firm announces a "Year of Efficiency," it resets the baseline for investor expectations.

In this context, austerity becomes a fashion. Leaders implement layoffs and budget freezes not necessarily because their specific P&L requires it immediately, but to signal "prudence" to the market. This performative discipline often ignores the specific operational needs of the company, leading to mimetic isomorphism—where firms copy each other’s cost-cutting strategies regardless of strategic fit, often exacerbating the market-wide downturn (Flynn & Sastry, 2024).

Mechanism 3: Threat Rigidity and Bandwidth Scarcity

Under the stress of an economic contraction, leadership teams suffer from "threat rigidity." The psychological pressure of a downturn narrows cognitive bandwidth, forcing leaders to retreat to well-learned, dominant responses—typically centralized control and cost-cutting (Staw et al., 1981).

This "scarcity mindset" reduces the capacity for complex decision-making. Instead of nuanced surgical restructuring (e.g., exiting a specific unprofitable geography), leaders deploy blunt instruments (e.g., "10% cuts across the board"). This indiscriminately severs "muscle" (revenue-generating talent) alongside "fat," damaging the firm's long-term competitive advantage.

Cheap Capital + Narrative of "Growth" → Over-Hiring & Project Sprawl (The Magpie Effect)

Revenue drops → Costs remain "Sticky" → Margins collapse faster than Revenue

Narrative shifts to "Austerity" → Threat Rigidity → Blunt Cuts to R&D/Talent

Permanent loss of capacity & culture → Inability to capture recovery → Structural Stagnation

Strategic Implications: Escaping the Cycle

The implications of this cycle extend beyond the balance sheet. They degrade the organisation’s ability to execute. To break the cycle, leaders must apply discipline through four distinct lenses.

1. Unit Economics: The "Gross Margin" Truth

In a boom, volume hides a multitude of sins. Companies often scale products with negative unit economics, subsidized by venture capital or cheap debt. The implication for 2026 is that Gross Margin must replace Revenue Growth as the North Star metric. If a unit is not profitable at the contribution margin level today, it should not be scaled. Discipline means refusing to grow unprofitable revenue, even when capital is available.

2. Operating Leverage: Converting Fixed to Variable

The "Sticky Cost" problem is essentially a problem of rigid operating leverage. To avoid the need for panic cuts, firms must architect a cost base that breathes. This implies a strategic preference for variable cost structures—outsourcing non-core functions, using SaaS models that scale down as well as up, and avoiding long-term fixed leases for volatile business units. The goal is to make the cost curve as elastic as the revenue curve.

3. Decision Behaviour: The "Pre-Mortem"

To counter "Threat Rigidity," governance structures must force "Pre-Mortem" analysis during good times. Before approving a major budget expansion, the Board must ask: "If revenue drops 20% next year, exactly how do we unwind this cost?" If the answer involves complex severance or write-downs, the expansion should be reconsidered or structured differently. This introduces friction to the "Magpie Effect."

4. Capital Allocation: The "War Chest" Mentality

Cash hoarding is often criticized as inefficient, but in a volatile era, it is a strategic asset. However, the motivation matters. Hoarding cash out of fear (precautionary motive) leads to paralysis. Hoarding cash as "dry powder" (strategic motive) allows for counter-cyclical investment. The implication is to separate "Safety Cash" (6 months opex) from "Opportunity Cash" (M&A war chest), preventing the former from being spent on the latter during a boom (Graham & Leary, 2017).

Reactive cuts. Cutting muscle. Fear-based. High Hysteresis risk.

Counter-cyclical. Investing in efficiency when rich. "Dry Powder" ready.

Denial. Burning cash. "Wait and see." Existential threat.

Magpie effect. Bloat. "Growth at all costs." Future vulnerability.

Regional Lens: Context Matters

- United Kingdom: The post-Brexit economic stagnation has created a baseline of "permanent austerity" in many sectors. However, UK labour rigidity (compared to the US) makes "panic cutting" more expensive and slower. UK firms must prioritize hiring freezes earlier in the cycle rather than relying on layoffs later.

- United States: The US market is characterised by high "employment flexibility." This enables faster corrections but exacerbates the "Narrative Contagion." US firms are more likely to cut costs purely to align with Wall Street fashion (e.g., the tech layoffs of 2024/25) even if balance sheets are strong.

- Australia & NZ: Resource-dependent economies often face sharper cyclical swings. The danger here is "capital project hysteresis"—cancelling major infrastructure or mining projects during a dip, only to face massive restart costs when commodity prices rebound.

The 10-Step Roadmap to Permanent Hygiene

Rationale: Traditional budgeting incentivises waste in Q4. Allow departments to "rollover" 50% of savings to a strategic pot.

Rationale: Full ZBB is too heavy. Targeting the top 3 discretionary lines forces justification without paralysing ops.

Rationale: Cooling-off periods reduce impulse spending driven by "urgency" narratives.

Rationale: "Run" costs should deflate with scale. "Grow" costs are bets. You cannot manage what you do not separate.

Rationale: Removes emotional labour from the CFO. The system rejects the expense, not the person.

Rationale: SaaS sprawl is the silent killer. Auto-cancel seats with <30 days activity.

Rationale: Stops the discounting behaviour that erodes unit economics during growth phases.

Rationale: Radical transparency aligns the team on the scarcity reality, reducing the "Magpie Effect."

Rationale: These are sunk cost fallacies draining cognitive bandwidth.

Rationale: Changes the cultural narrative. Efficiency becomes "cool," not just "necessary."

• Anderson, M. C., Banker, R. D., & Janakiraman, S. N. (2003). "Are selling, general, and administrative costs 'sticky'?" Journal of Accounting Research.

• Cerra, V., Fatás, A., & Saxena, S. C. (2023). "Hysteresis and Business Cycles." Journal of Economic Literature.

• Flynn, J. P., & Sastry, K. A. (2024). "The Macroeconomics of Narratives." NBER Working Paper Series.

• Graham, J. R., & Leary, M. T. (2017). "The Evolution of Corporate Cash." NBER Working Paper No. 23767.

• Shiller, R. J. (2017). "Narrative Economics." American Economic Review.