Debt Anxiety 2026: Why Paying Down Debt Tops Agendas

Executive Summary

The global economy in 2026 presents a paradox: headline growth is steady, yet anxiety regarding balance sheet health has reached a decade high. The "zero interest rate" vintage of 2020–2021 debt is now hitting a massive maturity wall.

1. The Growth Paradox: Why Growth Burns Cash

Scaling too fast in a high-interest environment can kill a business. Use this simulator to see how "High Growth" deepens the cash valley.

2. Diagnostic: Where Do You Sit?

The market is bifurcating. Hover over the quadrants to diagnose your position in the 2026 credit hierarchy.

Use your strong balance sheet to acquire distressed competitors.

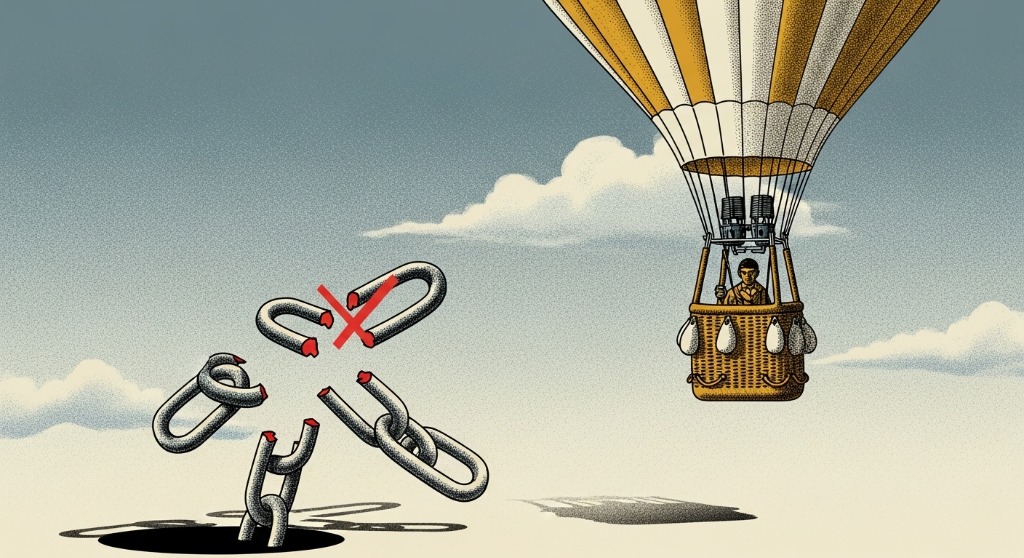

Pause all growth capex. Focus 100% of FCF on debt reduction.

Preserve optionality. Do not commit to long-term OpEx.

Likely requires a distressed exchange or equity injection.

3. Calculate Your "Funding Gap"

How much working capital do you need to fund your growth next year?

10-Step Implementation Roadmap

A tactical playback for achieving "Fortress" status.